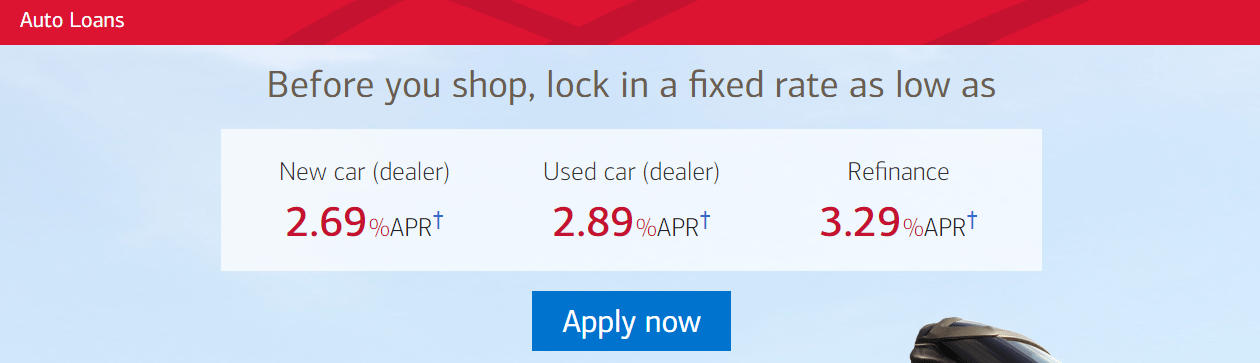

With UMB Bank, personal banking is made easy with a suite of services from checking and savings accounts to credit services, investing and wealth management. We help you manage your money, meet your financial goals and finance your next big purchase. Our personal checking accounts and savings accounts are designed with your needs in mind, and we offer credit card and personal lending products with competitive rates.

The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month. And customers have access to an extensive ATM network. The savings account pays a competitive rate and Discover offers a suite of other products and services. We rated them on criteria including digital experience and ease of mobile apps, as well as annual percentage yields, minimum balances, fees and more.

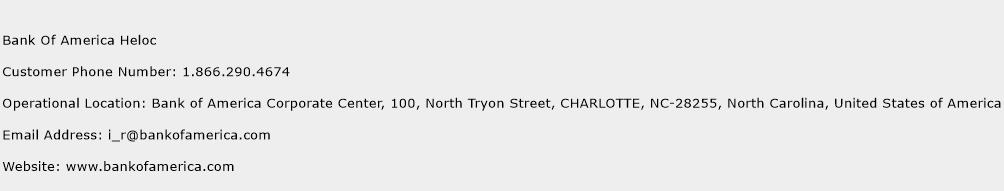

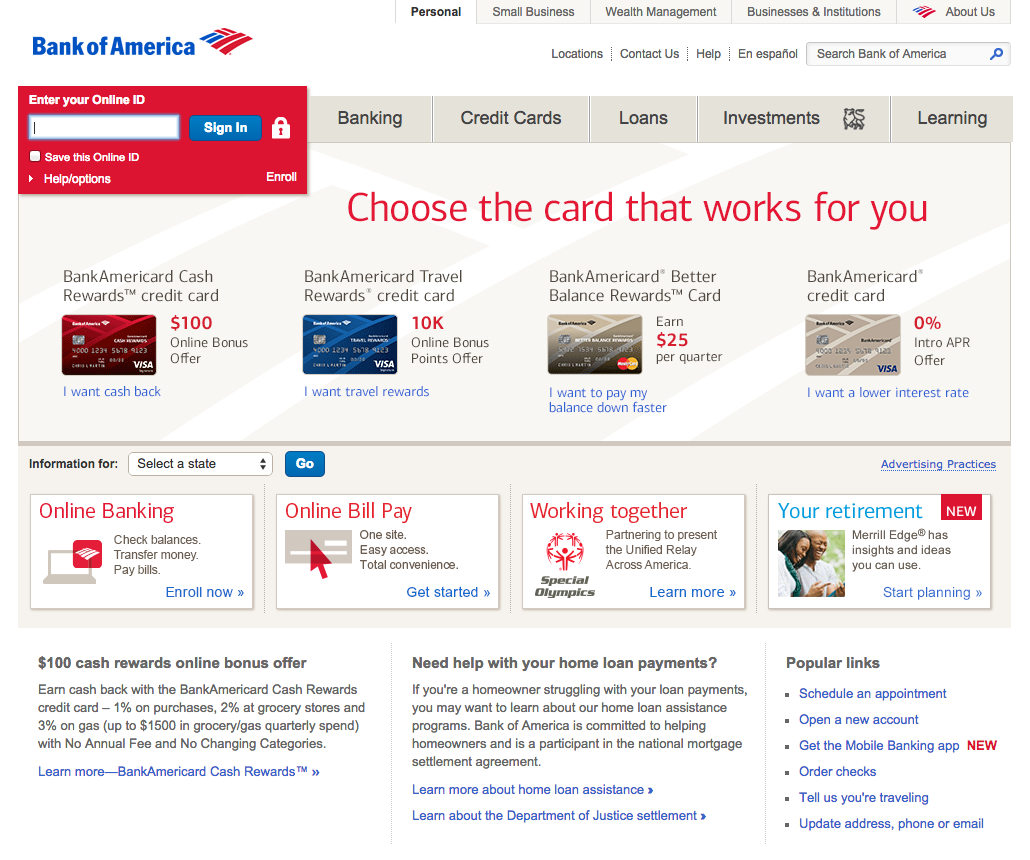

For this roundup, we considered only those services with the highest scores for web and mobile experience within their respective categories that are widely available across the country. Calling Bank of America if you suspect fraud or identity theft is often the fastest and most effective way of regaining control of your credit cards or accounts. Bank5 Connect offers a checking account, savings account and CDs with terms from six months to 36 months. The mobile app gets 5 stars out of 5 on the App Store and 4.2 out of 5 stars on Google Play .

Rates at BankFive may be higher or lower than rates at Bank5 Connect, depending on the product you choose. Quontic Bank offers one savings account, three checking accounts, a money market account and five CDs with terms ranging from six months to five years. Quontic recently launched its Bitcoin Rewards Checking account, only available in select states so far. The mobile app gets 4.5 stars out of 5 on the App Store and 3.2 stars out of 5 on Google Play. Quontic offers competitive APYs across its other products, along with low minimum deposit requirements and access to 90,000+ surcharge-free ATMs throughout the U.S. Quontic customers get all the features you may expect from a digital bank, including 24/7 access to online banking and a highly rated mobile app.

Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward. To create this list, Forbes Advisor analyzed the products and services of 60 online banks, including a mix of large and small online banks and neobanks. We ranked each bank on 11 data points within the categories of product offerings, fees, APY, minimum requirements, customer experience, digital banking experience, ATM network and availability. This bank has no monthly fees or minimum balance requirements for its checking or savings products.

Customers have access to an extensive ATM network and automatic savings tools. You may even receive your paycheck up to two days early with direct deposit. Axos offers five different checking accounts, one savings account, one money market account and CDs with terms that range from three months to five years.

Its mobile app gets 4.7 stars out of 5 on the App Store and 4.5 stars out of 5 on Google Play. Online banks offering the highest APYs and lowest fees across its products rose to the top of the list, as did those with a low minimum deposit and balance requirements and a broad ATM network. Banks with high customer satisfaction and an intuitive digital banking experience also earned higher scores.

To appear on this list, the bank must be an online bank with national availability. Online banks typically offer low fees, high APYs and intuitive digital banking tools. But the best online bank for you is the one that meets your financial needs, whether that's a single savings account or a full-service bank. When shopping for the best banking relationship for you and your family, keep in mind what you need most from an online bank. The best mobile banking services give you access to financial services anytime you want.

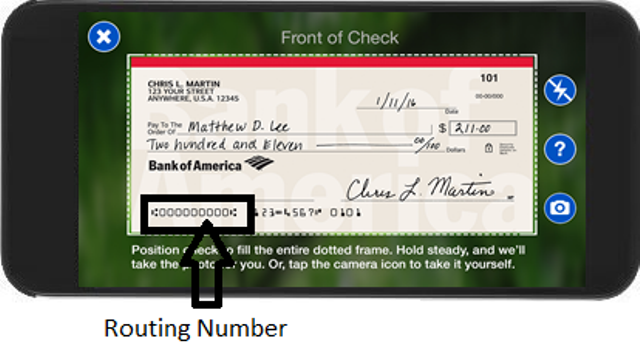

With banking apps — or a bank website — on your phone or tablet, you can complete many common tasks, including checking your account balance, finding nearby ATMs and depositing a check by snapping a photo. ¹ Transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card. Recipients have 14 days to register to receive money or the transfer will be canceled.

Customers of online banks can initiate transactions online, through a mobile app, by phone or by mail. They also can link online bank accounts with accounts they have at traditional banks, credit unions or other online banks. Convenience is crucial in the world of digital banking. With an online bank, your primary interactions take place via the bank's website and mobile app.

The best online banks provide a simple online interface and highly rated mobile apps for banking on the go. Check out reviews of the mobile app on the App Store and Google Play. The online bank you choose depends heavily on the products you need. Some online banks are full-service financial institutions, offering checking, savings, money market accounts, CDs and other products. Generally, Bank5 Connect offers a winning combination of attractive rates and low minimum deposit requirements across its products. It requires only $10 to open a savings or checking account and a relatively easy-to-meet $500 minimum deposit requirement to open a CD.

There are no monthly maintenance fees on any of its accounts. Quontic Bank offers a cash rewards checking account that pays up to 1.50% cash back on qualifying debit card transactions each statement cycle. The bank also offers a separate high interest checking account that pays up to 1.01% APY so long as certain monthly requirements are met. Ally Bank offers a savings account, interest-checking account, money market account and CD terms from three months to five years. It also offers a raise your rate CD with terms of two and four years and a no-penalty CD with a term of 11 months.

The mobile app gets 4.7 stars out of 5 on the App Store and 4.2 stars out of 5 on Google Play. If you're looking to replace your current bank, focus on the overall package. Look for an online bank that keeps fees and minimum requirements low, offers high APYs and provides easy access to your money via ATMs and mobile apps. Seek out a bank with excellent customer service as well.

Online banks typically don't offer branch access. That's why it's essential to keep customer support in mind when shopping for an online bank. Look for a bank that offers easily accessible customer service representatives or online chat alternatives. In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPal®, who also provide P2P payments) may not be eligible for cash back rewards. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc., registered in the US and other countries.

Venmo and PayPal are registered trademarks of PayPal, Inc. FNBO offers personal, business, commercial, and wealth solutions with branch, mobile and online banking for checking, loans, mortgages, and more. Chase Bank serves nearly half of U.S. households with a broad range of products.

Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. If you need your personal checking account to do more for your financial plan or to help your money work harder and fuel financial growth, UMB has a personal bank account that is right for you. Our personal savings accounts are designed with features and benefits that help you take the next step in your financial journey.

Not sure which personal bank account is right for you? TIAA offers standard mobile banking services, including bill pay, money transfer and mobile check deposit, and its apps earn high ratings in the app stores. You may redeem rewards dollars for account credits to be deposited to your First Citizens checking or savings account or applied to your First Citizens credit card, consumer loan or mortgage. Online banks don't have the costs associated with traditional brick-and-mortar institutions. As such, they tend to pass those savings on to customers in the form of lower fees, higher rates and intuitive digital banking products. But not all online banks are the same, and some offer better products and experiences than others.

With the Purchase Rewards program, the more you use your debit card, the more offers you are likely to receive—offers are matched to your spending habits. Cash-back offers are available for limited time frames and you must activate them within the app before using your connected card to redeem the offer. You're enrolled in the program automatically when you open a checking account. Salem Five Direct offers a checking account, a savings account and CDs with terms from 12 months to 36 months.

The mobile app gets 4.7 stars out of 5 on the App Store and 4.1 stars out of 5 on Google Play. Chime offers a spending account and a high-yield savings account. Banking services through Chime are provided by The Bancorp Bank or Stride Bank, N.A. For ATM transactions outside of the Chime network, the charge is $2.50. The mobile app gets 4.8 stars out of 5 on the App Store and 4.6 stars out of 5 on Google Play.

In addition to its budgeting tools, Chime offers competitive rates on savings, limited fees and no minimum requirements. It also has an attractive mobile app (one that's highly rated by its users) and it offers fee-free access to an extensive ATM network. Ally's online checking account earns interest and has no monthly fees, while its online savings account lets you organize your savings goals into different categories.

The savings account's attractive rate is higher than what you can expect to find at larger traditional banks. The redemptions will post within 2 to 8 business days. Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits.

Because they generally don't incur the costs to open and operate a network of branches, online banks tend to offer higher rates on deposit accounts and lower fees. Keep in mind that this trade-off means you often can't walk into a branch if there's a problem. Instead, you'll be communicating over the phone, via email or online chat to resolve any issues.

We've compared the products and services of 60 nationally available online banks to find some of the best options available. See below to learn more about why we picked each account, the pros and cons, and to access individual bank reviews. Comparison conducted by an independent research firm and based on data compiled in May 2021 from company websites, customer service agents, and consumer checking account offers. In some cases, competitors assess and/or waive fees if certain criteria are met.

Checking & savings accounts, online & mobile banking, debit cards, and more. Our products and services are designed to fit your lifestyle. With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll.

Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. The combined balance is calculated based on your average daily balance for a three calendar month period. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. Your benefits become effective within one month of your enrollment, or for new accounts within one month of account opening, unless we indicate otherwise. You can set up a one-time or recurring direct deposit transfer to the financial institution of your choice at no cost to you.

Visit Bank of America Debit Card or call Bank of America debit card customer service at the phone number on the back of your card. The redemptions will post within 2-8 business days. The best online banks are those that meet your needs. If you're happy with your current banking relationship but want to earn more interest on your savings, consider finding an online bank with a competitive high-yield savings account. Along with paying 0.20% APY on balances of $100 and over, Bank5 Connect's checking product offers Purchase Rewards. This no-cost program lets you earn cash back when you use your Bank5 Connect debit card at participating retailers and restaurants.

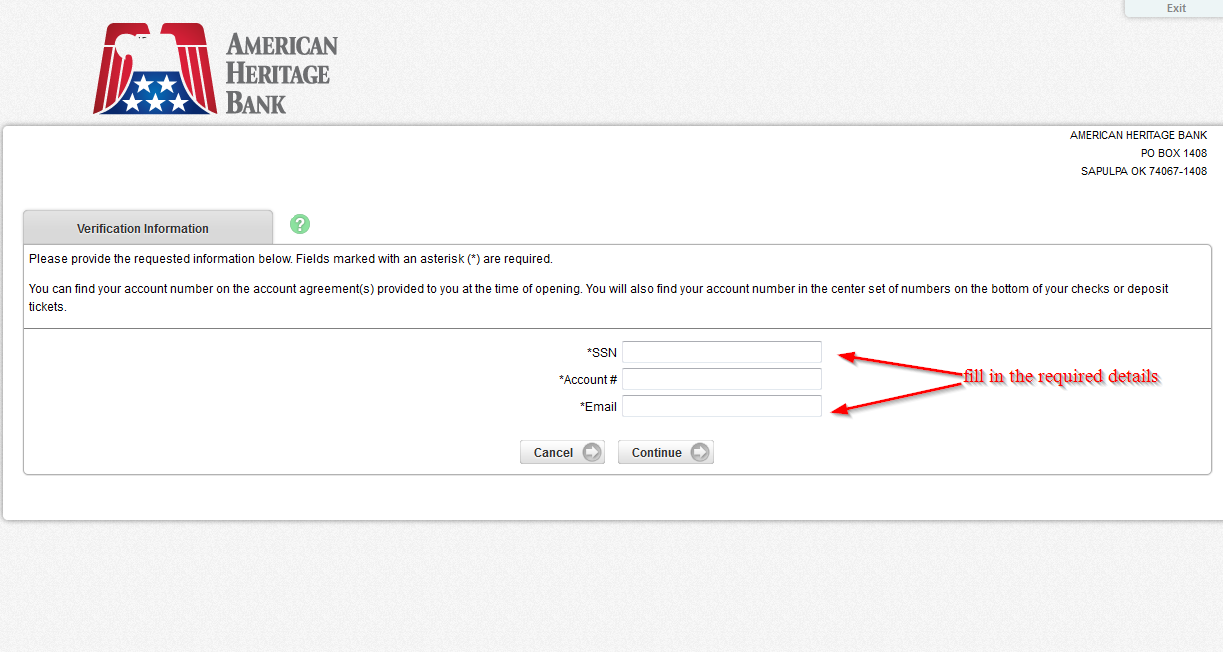

It's relatively rare to find a checking account that offers both interest and cash back. Varo gets solid customer service ratings and mobile app reviews. Customer service representatives are available by phone or email seven days a week. Woodforest is a community bank built upon the needs of the customers we serve. We are committed to earning customer loyalty by offering the highest level of customer service as well as competitive products and services by employees who are fair, responsive, and professional. MCU will never contact you by email, text message or phone to ask you to update or verify your account information.

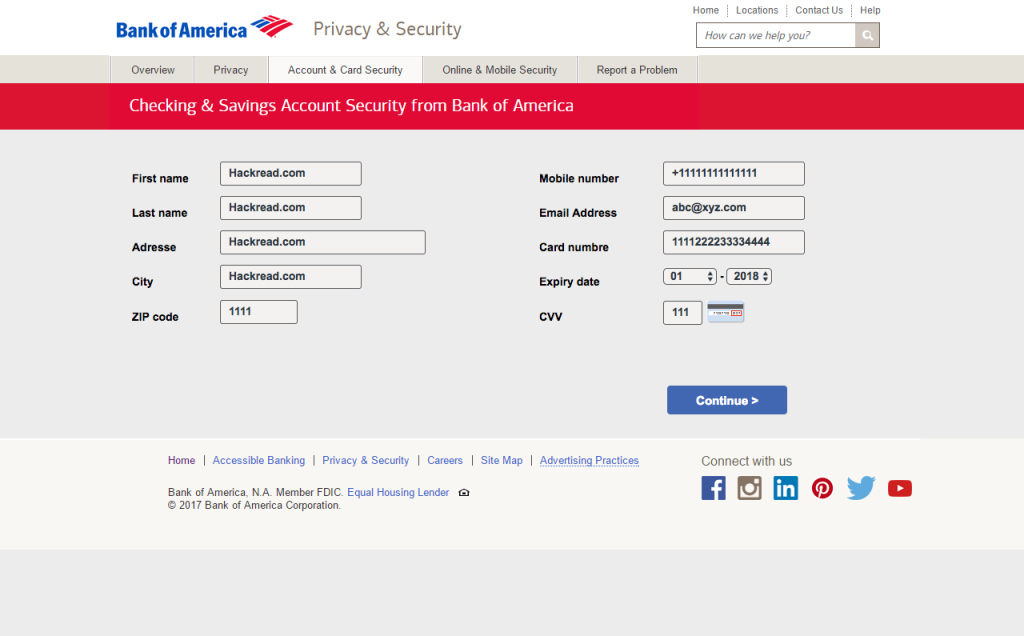

During the online banking login process, we will never ask you to further verify your login by inputting credit card or account information. As the Exclusive Banking Partner of the Kansas City Chiefs, we want to give all of Kansas City the opportunity to bank like a champion. Our Chiefs Checking is a free checking account with cheer-worthy perks like 1% cash back8 on the first $500 of monthly purchases, an exclusive Visa® Chiefs debit card, discounts at the Chiefs Pro Shop and more.

Choose the checking account that works best for you. See our Chase Total Checking®offer for new customers. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches. Checks can take up to 5 days or longer to go from the merchant to the bank and then post to your account. In most cases, unlike with debit card transactions, the bank does not know you have spent the money until the transaction comes in to post to your account.

BBVA USA customers will receive new PNC account and routing numbers at or near conversion, anticipated in October. We understand the inconvenience this may cause and are committed to making this a smooth process. When BBVA USA account transition to PNC Bank, direct deposits to checking, savings or money market accounts will continue without interruption, and PNC will support BBVA customers using BBVA checks. Mortgage and home equity products are offered in the U.S. by HSBC Bank USA, N.A. And are only available for property located in the U.S. Discounts can be cancelled or are subject to change at any time and cannot be combined with any other offer or discount.